Mergers and acquisitions (M&As) are strategic moves for businesses to enhance capabilities, increase market share, and foster innovation in the digital economy.

Mergers and acquisitions (M&As) are strategic moves for businesses to enhance capabilities, increase market share, and foster innovation in the digital economy. However, beneath the surface of these business transformations lies a complex data integration challenge that threatens to undermine their value.

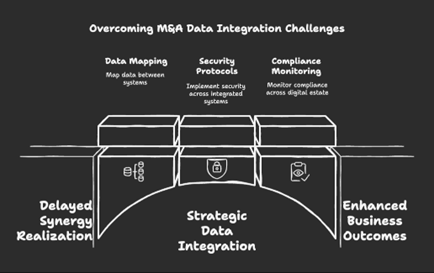

According to recent Gartner research, 40% of expected business outcomes from M&A activities fail to materialize because of complications during technology integration phases. Meanwhile, Deloitte’s “M&A Technology Trends 2024” report reveals that data integration challenges account for 37% of delayed synergy realization in corporate mergers.

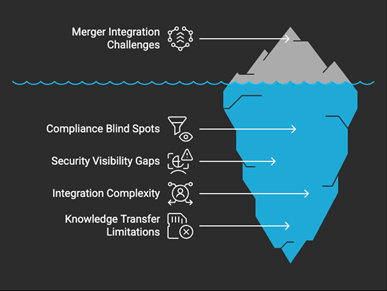

The challenge is particularly acute for security and data leaders tasked with safely incorporating acquired systems while maintaining visibility, security, and compliance across an expanding digital estate.

When Company A acquires Company B, it inherits not just business assets but entire data ecosystems—often with inadequate documentation, legacy systems, and complex interdependencies. For security and data leaders, this presents immediate challenges:

According to Forrester’s “Data Governance In The Age of M&A” (2023), organizations need on average 7-10 months to achieve full data visibility across acquired systems when using traditional methods. During this period, 83% report operating with significant compliance uncertainties.

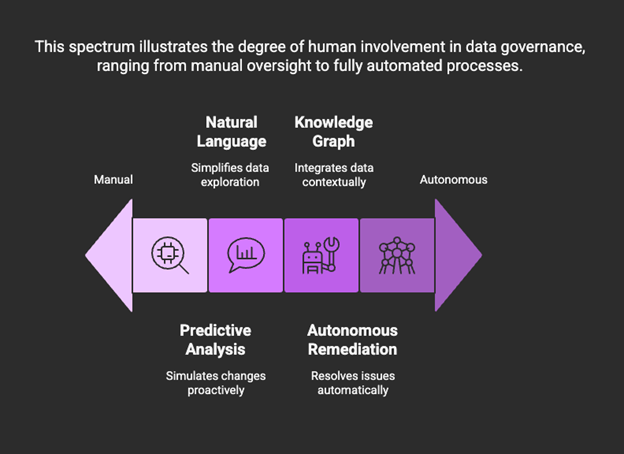

The traditional approach to post-merger data assessment—manual discovery processes, interviews with remaining staff, and documentation review—is no longer sufficient in environments with thousands of data assets and complex interconnections.

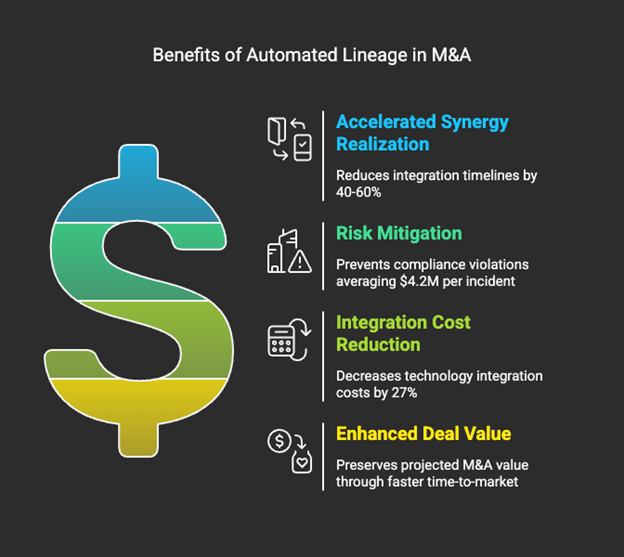

“In the current business environment, manual approaches to data lineage cannot scale to the complexity of modern enterprise architecture,” notes Gartner’s 2024 Market Guide for Data Integration Tools. The report continues, “By 2026, organizations leveraging automated data lineage will reduce M&A technology integration timelines by 40% compared to those using manual processes.”

IDC’s 2024 Data Intelligence Maturity Index further underscores this point: organizations with mature automated data lineage capabilities report 67% faster identification of high-risk data assets following acquisitions and a 42% reduction in data-related compliance incidents.

In 2023, a major pharmaceutical company (anonymized as PharmaGiant) acquired a mid-sized biotech firm with valuable research assets. Traditional integration approaches projected a 14-month timeline to achieve full data visibility and compliance assurance.

The CISO and CDO jointly implemented an automated data lineage platform, which delivered:

“The automated lineage approach didn’t just accelerate our compliance timeline—it fundamentally transformed our understanding of the acquired company’s data landscape in ways manual discovery never could have accomplished,” noted PharmaGiant’s CISO.

Modern data lineage platforms overcome the limitations of manual approaches through:

According to the SANS Institute’s 2024 Data Security Survey, organizations implementing automated data lineage tools reduce their time-to-compliance by an average of 58% in M&A scenarios, while simultaneously improving confidence in their compliance status by 76%.

The most successful organizations are now integrating automated data lineage capabilities directly into their M&A playbooks, rather than treating it as a post-merger afterthought:

Pre-Acquisition Phase

Early Integration Phase

Mature Integration Phase

The National Institute of Standards and Technology (NIST) Privacy Framework, particularly its “Identify-P” function, provides a structured approach to implementing data inventory and flow mapping during M&A transitions. Organizations following NIST-aligned processes report 41% fewer post-merger privacy incidents than those using ad-hoc approaches.

Based on best practices from organizations that have successfully managed complex M&A data transitions, we recommend the CLEAR framework for implementing automated lineage:

Organizations following this structured approach report achieving complete data visibility 3.2x faster than those using traditional methods, according to ENISA’s “Data Security in Corporate Restructuring” report (2024).

When evaluating automated lineage tools for M&A scenarios, security and data leaders should prioritize:

As noted in the Gartner Magic Quadrant for Metadata Management Solutions, “Organizations should prioritize solutions that combine deep technical lineage with business context translation to support both technical teams and governance stakeholders during merger integrations.”

Beyond the technical benefits, automated lineage delivers quantifiable business value in M&A scenarios:

Looking ahead, next-generation lineage tools are incorporating advanced AI capabilities to further enhance M&A data integration:

According to IDC, by 2026, 75% of Global 2000 enterprises will employ AI-enhanced data lineage tools to manage complex data environments resulting from M&A activity and multi-cloud adoption.

Data lineage has evolved from a technical compliance exercise to a strategic enabler of successful mergers and acquisitions. Organizations that implement automated lineage capabilities gain more than just regulatory assurance—they unlock faster integration timelines, reduced costs, and enhanced value from their M&A activities.

For CISOs, CTOs, and data leaders navigating the complexities of post-merger integration, automated lineage offers a path from uncertainty to confidence, from manual discovery to scalable visibility, and ultimately from integration bottleneck to strategic advantage.

This article is part of our executive insights series on data security and governance in complex enterprise environments. Contact us to learn more about implementing automated data lineage in your M&A strategy.

Post Tags :

Share :

Assess. Measure. Fortify.

Keep Your Assets Safe With Our

Cutting-Edge Cybersecurity Solutions.

Developed by HACKTRONIAN